Net Present Value Excel Template

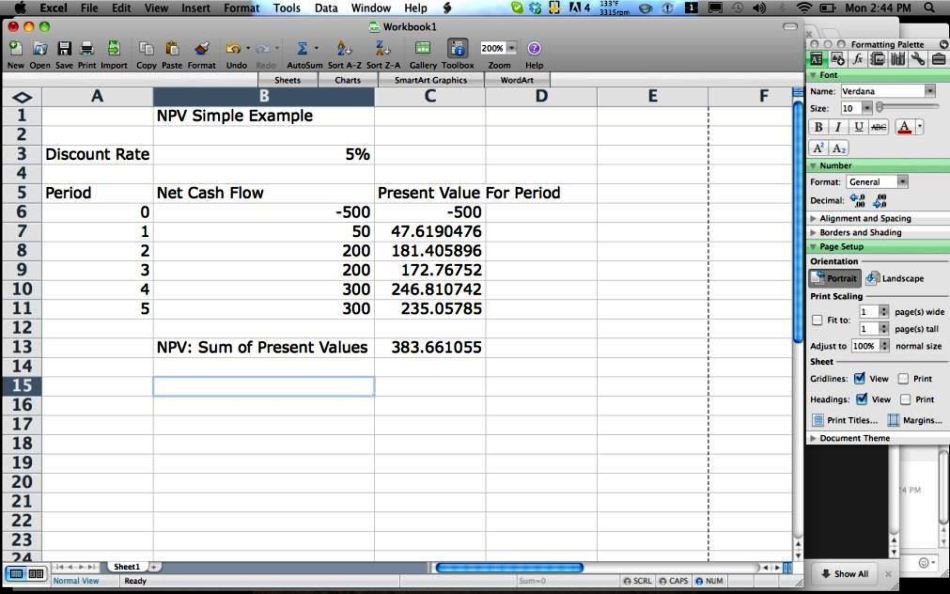

Net Present Value Excel Template - You can use excel to calculate npv instead of figuring it manually. Web net present value (npv) is the value of a series of cash flows over the entire life of a project discounted to the present. Web npv is the value that represents the current value of all the future cash flows without the initial investment. Get started today and make informed decisions about your investments! Establish a series of cash flows (must be in consecutive cells).

Web calculates the net present value of an investment by using a discount rate and a series of future payments (negative values) and income (positive values). An npv of zero or higher forecasts profitability for a project or investment;. Let me explain with an example. You can use excel to calculate npv instead of figuring it manually. The net present value (npv) represents the discounted values of future cash inflows and outflows related to a specific investment or project. Npv (short for net present value), as the name suggests is the net value of all your future cashflows (which could be positive or negative) Calculate the net value of debt financing (pvf), which is the sum of various effects, including:

Net Present Value Formula Examples With Excel Template

Web net present value (npv) is the value of a series of cash flows over the entire life of a project discounted to the present. In other words, you can find out the value of.

Net Present Value Formula Examples With Excel Template

How do you calculate net present value in excel? Cbca®commercial banking & credit analyst. Get powerful, streamlined insights into your company’s finances. The rate of discount over the length of one period. This net present.

8 Npv Calculator Excel Template Excel Templates

The discount rate is the rate for one period, assumed to be annual. Present value (pv) is the current value of a stream of cash flows. To do this, discount the stream of fcfs by.

6 Net Present Value Excel Template Excel Templates

In simple terms, npv can be defined as the present value of future cash flows less the initial investment cost: Free spreadsheet templates & excel templates. Establish a series of cash flows (must be in.

10 Excel Net Present Value Template Excel Templates

This net present value template helps you calculate net present value given the discount rate and undiscounted cash flows. The present value (pv) of a stream of cash flows refers to the value of. Web.

10 Excel Net Present Value Template Excel Templates

The correct npv formula in excel uses the npv function to calculate the present value of a series of future cash flows and subtracts the initial investment. Get powerful, streamlined insights into your company’s finances..

Net Present Value Calculator Excel Template SampleTemplatess

Web net present value (npv) excel template helps you calculate the present value of a series of cash flows. Web npv is an essential tool for corporate budgeting. Cbca®commercial banking & credit analyst. Web the.

Net Present Value Calculator »

Web the npv function is categorized under excel financial functions. Get powerful, streamlined insights into your company’s finances. Npv in excel is a bit tricky, because of how the function is implemented. X0 = cash.

Net Present Value Calculator Excel Templates

Fmva®financial modeling & valuation analyst. Get started today and make informed decisions about your investments! Npv (short for net present value), as the name suggests is the net value of all your future cashflows (which.

Professional Net Present Value Calculator Excel Template Excel TMP

Free, easy returns on millions of items. Calculate the net value of debt financing (pvf), which is the sum of various effects, including: What is the net present value formula? For example, project x requires.

Net Present Value Excel Template The formula for npv is: The bigger the discount rate, the smaller the present value. For example, project x requires an initial investment of $100 (cell b5). Establish a series of cash flows (must be in consecutive cells). Web the present value of annuity can be defined as the current value of a series of future cash flows, given a specific discount rate, or rate of return.